Our headline inflation has recently gone up to its three-year high, but what are the drivers of Philippine inflation, and how are they managed?

What is the latest trend in Philippine inflation?

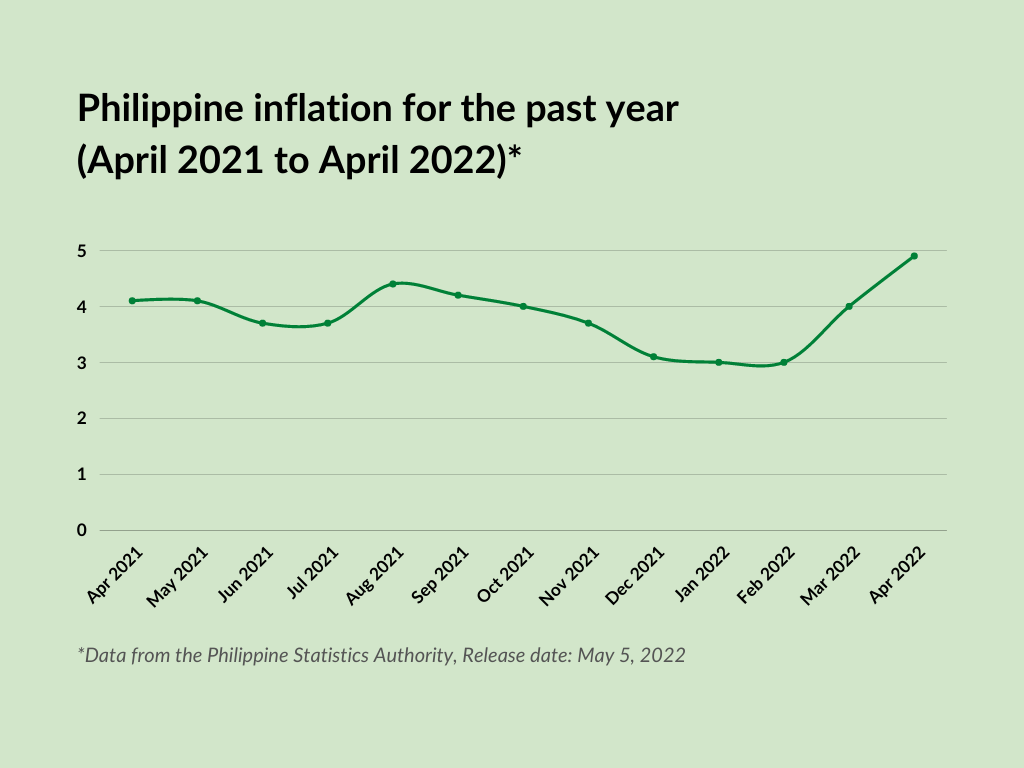

This May, the Philippine Statistics Authority (PSA) recorded the country’s highest inflation thus far at 4.9% for April [1]. Compared to last year, this is 0.8% higher than the 4.1% inflation from April 2019. Furthermore, this is also the highest recorded inflation since January 2019. The Philippine inflation started at a flat rate of 3.0% in February and January, and it spiked to 4.0% last March[2]. But what are the reasons behind these numbers? What are the local and international issues that affect Philippine inflation? Before we go into that, let us first look at how inflation is measured.

How is the Philippine inflation rate measured?

There are two measures of inflation. First is the core inflation, which measures the long-term trend or movement in the average consumer prices. The second one is ‘headline inflation,’ which measures how fast the Consumer Price Index (CPI) changes.

In other words, core inflation is the measure of the change in consumer prices without the volatile aspects of CPI. On the other hand, headline inflation measures the changes in the cost of living based on the prices of commodities and services typical Filipino families consume.

What are the factors and drivers of Philippine inflation?

The Bangko Sentral ng Pilipinas (BSP) sets its baseline forecasts at the beginning of each year to create appropriate monetary policies. However, factors beyond the central bank’s control can still rattle the headline inflation rates. These include unexpected changes in agricultural product prices and oil prices, calamities, or government policy changes.[3]

Volatile oil prices and their effect on Philippine inflation

Rising oil prices have a directly proportional relationship with inflation. This means that inflation rates rise with oil price hikes. But why? Because most industries are dependent on oil. When oil prices spike, so do production costs. And these industries pass these costs to the consumers, increasing the prices of goods and services.

For instance, the ongoing Russia-Ukraine war recently drove oil prices to unprecedented levels. As a result, the Philippines felt its first impact on inflation last March. Notably, the PSA recorded the highest increases in the indices of transport, food and non-alcoholic beverages, and housing, water, electricity, gas, and other fuels.

Volatile agricultural product prices and their effect on Philippine inflation

One of the biggest drivers of inflation is food prices. When agricultural product prices increase, so do their respective indices. This, in turn, drives the headline inflation up. Some of the reasons food prices may go up exponentially are food supply disruptions and other supply chain problems. Additionally, the spread of viruses such as bird flu and swine fever could affect poultry and livestock supplies and drive up their prices.

Calamities and their effect on Philippine inflation

Like world events, calamities also have an impact on Philippine inflation. For example, the aftermath of the typhoon “Odette” last December 2021 kept commodity prices high. The inflationary pressures were mainly from the elevated fuel shortages, infrastructure damages, and telecommunications outages. As a result, these disruptions caused higher fuel and commodity prices resulting from the scarcity of food, drinking water, and other essential goods.

Government policies and their effect on Philippine inflation

Government policies can affect inflation just as much as external economic forces. In fact, it is one of the primary duties of central banks to sustain a manageable inflation rate. For example, one of BSP’s fundamental mandates is to “promote a low and stable inflation” to create sustainable economic growth.

For most central banks, inflation rates are essential metrics for making monetary policies. This is an inflation-targeting strategy. In other words, the BSP primarily looks at the inflation rate when increasing or decreasing interest rates to control the supply of money circulating in the market. For an inflation-targeting country like the Philippines, a stable inflation rate is the end goal of its policies.

During the previous year’s meat inflation, the government managed the price increase by having more imported pork. These pork imports aim to increase local supply and ensure affordable food prices for the National Capital Region and nearby provinces to counter the spike in food items.

Is inflation always a bad thing for the Philippine economy?

Inflation is not always bad for the Philippine economy. In fact, the BSP has already expected these inflation numbers. There are healthy levels of inflation that are generally good for the economy because they indicate that it is growing. For the Philippines, the projected inflation for the next two years is at 2% to 4%. Though the latest inflation rate from April went way beyond 4%, the average inflation for the year is still below the 4% ceiling at 3.7%.

What happens when inflation rates go beyond expectations?

As part of its mandate, the BSP handles the policies that counteract the effects of inflation when it goes above expectations. The government can also implement fiscal policies like increasing taxes and imposing high-interest rates to control the demand in the economy. But in cases of cost-push inflation driven by high oil prices, conventional monetary policies may not be enough. In these instances, the government needs the best monetary policies coupled with unemployment management strategies and addressing the causes of inflation.

How does inflation affect investments?

Inflation affects almost every aspect of an economy. For instance, high inflation alerts investors because they mean fewer earnings from bonds and stocks. Secondly, inflation can also chip away at your savings when it accelerates faster than bank interest rates. Next, investments with fixed income rates like treasury bills are also at risk of income reduction. For other assets like real estate properties, inflation can be good. When commodity prices are high, land values and rent prices also increase, keeping property investors’ profit margins.

Check out properties to hedge against inflation

Browse through Camella’s house and lot communities and vertical villages across the Philippines!

Sources:

[1] Summary Inflation Report Consumer Price Index (2018=100): April 2022.

[2] Summary Inflation Report Consumer Price Index (2018=100): March 2022.

[3] Bangko Sentral ng Pilipinas Economic Newsletter, No. 09-04 August 2009. Retrieved from:https://www.bsp.gov.ph/Media_And_Research/Publications/EN09-04.pdf