Do you know how much inflation rates affect you every day? With the ongoing health crisis in the country and the pause in our economy, the Philippines’ inflation rate has jumped to an overwhelming 4.9 percent in August 2021, as recorded by the Philippine Statistics Authority (PSA). This is a 0.9 percent increase from the 4.0 percent record in July. The rate in August 2021 is the highest inflation recorded since January 2019.

This September, the Philippines’ headline inflation slowed down to 4.8 percent. The PSA cites the following commodity groups for this slowdown:

- Food products and non-alcoholic beverages

- Furnishing, household equipment, and routine maintenance of the house

- Communication

- Education

From a geographic perspective, the slowdown was mostly driven by the deceleration in the National Capital Region (NCR). The inflation for the rest of the country is at 5.2 percent.

What was the projected rate of inflation for 2021?

Earlier this year, the government has set its inflation target range from 2 to 4 percent. However, the actual average inflation rate from January to May 2021 went beyond the expected range at 4.4 percent.

What do these inflation rates mean?

The International Monetary Fund (IMF) defines the inflation rate as a broad measure of prices in a country over a specified time. This can be the overall increase in the prices of goods or the hike in the cost of living in a state or territory. For instance, think of inflation as the rate of increase in the prices of a bundle of goods over the year.

How is the inflation rate measured?

While the inflation rate covers a broad market, it can also be measured in smaller terms like the consumer cost of living. To measure inflation, government agencies divide goods into groups or baskets. Within this basket are goods that people commonly buy, and agencies track price movements by conducting surveys from time to time. In the Philippines, this is measure through the Family Income and Expenditure Survey (FIES) done by the PSA every three years.

To accurately track inflation, historical data is needed as these numbers have to be measured relative to a base year. This is where the consumer price index (CPI) comes in. The CPI is the cost of a basket of goods at a particular time measured relative to a base year.

In other words, the CPI identifies periods where there is an increase in your everyday expenses. When there is an increase in CPI, there is inflation or a steady increase in the price of goods.

Consumer Price Inflation

The CPI gives rise to the most common measure of inflation, which is the consumer price inflation measured in percentages. For example, if the base year CPI is at 100, and the present is 105, it means that there has been a 5 percent inflation over that time.

Headline Inflation

Headline inflation measures the total inflation in an economy. This means it includes commodity groups like food and energy, which fluctuate regularly. This volatility makes inflation calculation hard, so headline inflation is substituted with core inflation.

Core Inflation

In the Philippines, core inflation is the headline CPI without food and energy in the mix. That means core inflation measures the changes in the average consumer prices without the unstable items. Because of its more stable trend, core inflation is often used to indicate the Philippines’ inflation rate for the future and the long term.

Why is inflation constantly measured?

Inflation is constantly monitored because it decreases the welfare that citizens receive. By tracking the movement of prices, the concerned government agencies can create policies to influence and regulate your activities in the market.

How does inflation affect an average Filipino household?

More than a measure of price increases over a period of time, inflation rates affect Filipinos in many ways:

It lowers your money’s purchasing power.

Your purchasing power is your ability to purchase goods and services from the market. With high inflation indicating high prices of commodity groups, your P1,000 this month will afford lesser items than it did when compared to the previous month.

Inflation influences the cost of borrowing.

High inflation also means higher interest rates. As a lender, you would want to receive more compensation for lending your money when your money’s purchasing power decreases.

When inflation is low, the interest rates will also be low and more people will be encouraged to borrow money. As a result, it would circulate more money in the market and cause inflation.

To balance this out, government agencies keep track of inflation and deflation to know when to implement policies to keep the economy stable.

Inflation reduces the value of your savings.

As the cost of living goes up, the value of your savings decreases. The only way your money can avoid losing its value in the bank is when the interest rate cancels out the inflation rate. With goods priced high, your monthly savings may also need some cutting down, further decreasing your money in the bank.

What causes the high inflation in the Philippines?

The Philippines’ inflation rate is influenced by many local and international factors. Historically, the Bangko Sentral ng Pilipinas (BSP) has attributed headline inflation to drivers like agricultural food supply disturbances. One most relevant example is the minimal though a noticeable increase in the prices of goods after the Taal eruption in 2020.

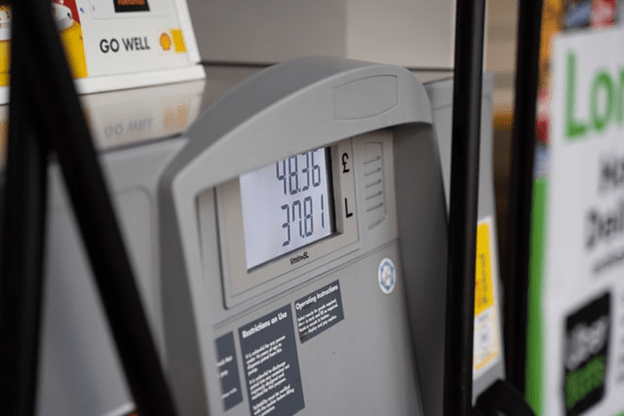

Inflation can also be driven by international oil price movements. As a country with industries dependent on imported oil, changes in its prices can become a multiplier for the prices of other goods in the market. When unregulated, it can also drive public transport fares to increase over time.

Does inflation have any advantage?

Inflation is not always bad, and it has its set of advantages. Moderate inflation can drive economic growth. This way, the prices of goods can adjust to their actual prices.

Based on historical data, inflation means employment is high. This is because more people are in the working force and they are earning more income. With more income, they spend more and circulate money in the market.

What are the best investments when inflation is high?

Now that we are experiencing unprecedented inflation rates, most of us may wonder where we should put our money. You already know that keeping it in the bank is not exactly profitable. You would want an investment that also gives you high returns when there is high inflation.

One way to secure that is through real estate investments. Your first option is Real Estate Investment Trusts (REITs), which are companies that earn from real estate developments. When inflation is high, rent is also high, which means your dividends are also increased.

- Related article: Everything You Need to Know About Philippine REITs

Another way to earn during inflation is through direct real estate income. It is already established that real estate generally only appreciates in value over time, and more so when inflation is high. As a result, you can also increase your property’s rent and get more returns.

These options make real estate your best shield against the impacts of increasing inflation rates.

Make the smart investment now and invest in properties for sale. For your options, you may check out Camella’s catalog of house and lot for sale or visit our property page.