Image source: https://www.freepik.com/free-photo/business-person-looking-finance-graphs_44137997.htm#fromView=search&page=1&position=21&uuid=409ad0d8-4764-4aec-9a52-852cd397e91e&query=easy+online+stocks

In today’s rapidly changing financial landscape, building an investment portfolio is no longer a privilege reserved for those with access to private brokers or large sums of money.

With the rise of online investment platforms in the Philippines, everyday Filipinos can now take the first step toward securing their financial future. These platforms are changing how people think about wealth.

They bring investing into a space that fits everyday life: accessible on a phone, easy to track, and flexible enough to match the rhythm of your income.

The Rise of Online Investment Platforms in the Philippines

Over the past decade, online investment platforms in the Philippines have evolved to offer more accessibility, flexibility, and control.

With just one account, investors can gain exposure to various asset classes such as stocks, bonds, funds, and even dividends-generating instruments.

These platforms simplify the process of stock market investing, making it easier for users to start trading or investing without relying entirely on a professional fund manager.

Part of this growth is supported by institutions like the Securities Clearing Corporation, which ensures secure and seamless settlement of transactions within the stock market.

Why You Should Consider an Online Trading Account

Opening an online trading account gives you the advantage of speed and access. Investors can buy, sell, and track their portfolio through a mobile app, allowing for quick decision-making in response to real-time market fluctuations.

Many platforms also feature educational tools, real-time market data, and analysis tools to help traders stay ahead.

Additionally, modern platforms often come with a user-friendly interface, making it easy to view gains, review your investment portfolio, and check on dividends, interest, and value accumulation.

Choosing the Right Trading Platform

Choosing the best trading platform comes down to more than just sleek design. Investors should examine key features such as transaction fees, ease of access, regulation, liquidity of assets, and support services.

A regulated platform ensures your capital is protected and that the company follows ethical business practices.

Also, consider the minimum amount required to open an account. Some platforms allow you to start investing with as little as ₱1,000, while others may require more.

This is an important consideration depending on your risk tolerance and budget.

Top Online Investment Platforms in the Philippines

COL Financial

As one of the most established names in the Philippine investment space, COL Financial offers access to stocks, mutual funds, and ETFs.

The platform offers robust tools for analysis and caters to both beginners and experienced traders. With its COL Starter, you can start investing with a minimum of just ₱1,000.

Website: COLFinancial.com

BDO Securities

Backed by one of the country’s largest banks, BDO Securities is fully integrated into BDO’s banking ecosystem, which means seamless cash transfers between your bank and trading account.

The platform supports stock market investing, and users can benefit from market insights and reports by in-house analysts.

Website: bdo.com.ph/bdo-securities

First Metro Securities

A subsidiary of Metrobank, First Metro Securities is known for its solid market research and investment advisory services.

It offers auto-invest options for mutual funds, making it a preferred choice for passive investors. The platform has been praised for its user-friendly interface and advanced trading tools.

Website: FirstMetroSec.com

App: FirstMetroSec GO

GCash and GInvest

GCash’s GInvest has made investing more inclusive. For as low as ₱50, users can invest in local and global funds.

The mobile app is intuitive, and the integration with your GCash wallet simplifies the transaction flow. It’s ideal for those looking to get started with minimal commitment.

App: GCash

Tool: GInvest (in-app feature)

Seedbox Philippines

This investment platform partners with ATRAM and offers professionally managed funds, including ESG-focused portfolios.

The platform’s auto-pay feature lets users automate their monthly contributions, helping them meet long-term financial goals.

Website: Seedbox.ph

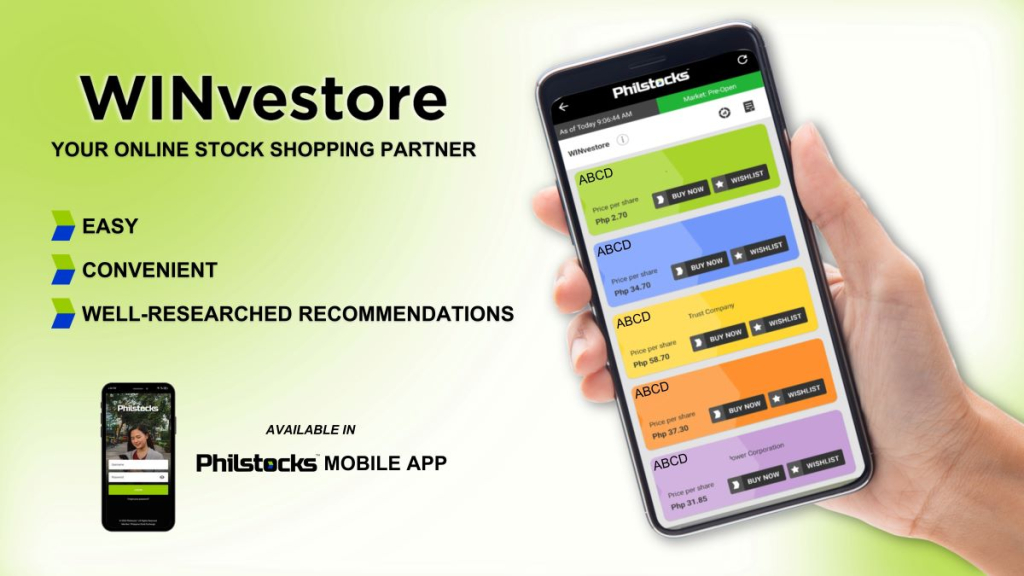

Philstocks

Image source: https://www.philstocks.ph/media/1333/banner-size-9.jpg

Philstocks provides a holistic online platform for stock trading and offers features like stock recommendations, real-time data, and research access.

It’s also connected to the Securities Clearing Corporation, giving traders confidence in the security and reliability of their transactions.

Website: Philstocks.ph

App: Philstocks Mobile

Key Benefits of Using Online Investment Platforms

Online investment platforms offer more than just access to markets. For Filipino investors with long-term goals, these platforms create real possibilities through a combination of technology, strategy, and ease of use.

Below are the core advantages that matter most to everyday investors.

Accessibility Without the Middleman

Opening an account and making your first trade no longer requires face-to-face meetings with a broker. Investors can register, fund their account, and begin buying or selling securities using only a smartphone or laptop.

This shift has made stock market participation more democratic, especially for those living outside urban centres.

Mobile App Convenience

Many platforms now offer well-designed mobile apps that allow you to check your portfolio, monitor gains, or adjust your positions on the go.

These apps serve as portable dashboards, providing real-time insights into your investment performance without requiring you to log in to a full desktop platform.

User-Friendly Interface That Supports Better Decision-Making

Design matters when money is involved. A user-friendly interface reduces friction and confusion—especially for new investors.

With clear layouts, helpful labels, and intuitive controls, these platforms make it easier to understand your current holdings, track your value, and make informed choices without second-guessing where to click next.

Auto Invest for Consistent Growth

Many platforms now offer auto-invest features that let users schedule regular contributions into chosen funds or stocks. This approach helps build discipline and removes the pressure of market timing.

It’s particularly effective for those with fixed monthly income or budgeting priorities, since it turns investing into a steady habit.

Customisable Goals and Asset Selection

Some platforms help users set specific financial goals—like buying property, funding education, or creating emergency savings—and match them with the appropriate asset classes.

This tailored approach aligns your money with your intentions, making the journey feel more personal and measurable.

Real-Time Tracking and Transparency

You no longer have to wait for monthly statements to understand where your money is. Online platforms update your portfolio values in real time.

This allows you to respond quickly to market changes, reassess your risk tolerance, and decide when to sell, reinvest, or stay the course.

What to Consider Before You Start Investing

Before signing up, evaluate your risk tolerance, understand your financial goals, and determine how much capital you can safely allocate. Review the fee structure—some platforms charge per transaction, while others have monthly or annual account maintenance charges.

Check the liquidity of the securities or funds you’re interested in. Liquidity affects how quickly and easily you can sell an asset without losing its value.

Consider the platform’s credibility, user reviews, and whether it’s registered with the appropriate regulatory bodies.

Start Investing with One Account, Many Opportunities

Today’s online investment platforms in the Philippines make it possible to build a diversified investment portfolio with one account.

Whether you prefer to manage it yourself or have a professional fund manager handle it, the tools are within reach.

For example, you might be saving to upgrade your lifestyle in the future. Families and young professionals looking to settle in secure and well-planned communities may find synergy between smart investing and property ownership.

Developments like Camella Homes—with properties in areas such as Camella Nueva Ecija and Camella Davao—are a long-term goal many Filipino investors work towards as they grow their portfolio.

The Future of Investing is Digital

As more Filipino investors turn to digital platforms, the competition among providers will likely drive innovation. Expect more features like AI-powered analysis, deeper integration with banks, and improved mobile app interfaces.

To stay ahead, make it a habit to track your portfolio, stay informed about market trends, and revise your strategies as needed.

Whether you’re growing your capital for retirement, education, or a dream house in a master-planned community, the key is to start investing, stay consistent, and maximise the benefits of modern financial technology.