Frequently Asked Questions

Here are some FAQs about home buying and more.

HOMEBUYER

Investing in a house and lot can guarantee you a good deal. You can choose to live in it, rent it, or sell it. Living in your own house and lot gives you more space, safety, security, and privacy. For investors, you can rent it or sell it, as house and lot properties appreciate better in the long-term. On top of all these, it is also more practical to buy a house and lot as you no longer need to hire contractors, architects, as well as process and secure permits.

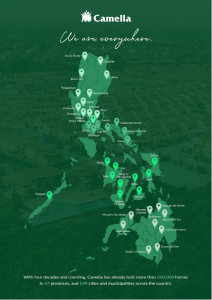

Camella, the largest homebuilder in the Philippines, is known for its beautiful, high-quality homes. For over four decades, it built dream homes, safe sanctuaries, and warm communities for the Filipino people. But way beyond homes, Camella has also created premier masterplanned communities across the country, where everything you need is near.

Camella spans nearly the entire country. It has built homes and communities in 47 provinces and 149 cities and municipalities across the Philippines.

Camella offers homes of different sizes to suit your needs, from 53 square meters to 166 square meters. If you are starting a family, having a bigger family, or planning to retire, there’s a Camella home for you.

Floor areas of common areas vary for every home. Check this link to see more about our homes.

Yes, for additional safety, all houses from Camella are built with a firewall.

Most of the house and lot units from Camella have provision for carport, which depends on the lot area. For the Grande Series, house unit Freya has a 1-car carport while Greta has a 2-car carport.

There is an extra space that you can transform into anything you need. It could be a garden area, play area, or an outdoor lounge area.

In order to avail of a house and lot from Camella, you must first and foremost inquire either directly through your preferred Real Estate Agent or through this website www.camella.com.ph. After an inquiry has been made, the Agent who assisted you will ask you if you want to be scheduled for a tripping or site viewing. This will allow you to appreciate and experience the project more personally. If you decide to push through with the purchase, an interview will be made between you and a marketing officer. After the pre qualifying inte

Standard Requirements:

- Photocopy of birth/marriage certificate

- Two (2) pieces 2×2 ID picture (for principal/spouse/co-borrower/Attorney-in-fact)

- Community Tax Certificate (applicant/spouse/children)

- Post dated Checks (for equity and amortization)

- Photocopy of Two (2) Valid Identification Cards (Company & Government)

- Proof of billing, Local Address (Utility Bills)

- Tax Identification Number

- House Sketch

For Overseas Filipino Worker:

- Original Certificate of Employment & Compensation (Consularized)

- Photocopy of Contract of Employment (valid 6mos after reservation)

- Photocopy of Passport (w/entries)

- Photocopy of Seaman’s Book

- Proof of Remittances for the last six (6) months

- Payslips for the last three (3) months

- Bank Statements for the last six (6) months

- Special Power of Attorney (w/ Consular Seal if notarized abroad)

- ITR latest two (2) years (resident abroad)

For Locally Employed:

- Photocopy of latest Income Tax Return (ITR) If filed separately, spouse ITR also.

- Original Certificate of Employment and Compensation

- Payslips for the last three (3) months (applicant and spouse)

- Bank Statements for the last three (3) months

- Vouchers for the last six (6) months (commissions)

For Self-Employed:

- Photocopy of Business Registration (DTI/ SEC)

- Mayor’s Permit

- ITR for the last two (2) years

- Franchise/OR/CR (for taxi/jeepney/bus operators)

- PTR (for practicing professionals)

- Bank Statements for the last six (6) months

- Picture of Business Establishments

- List of clients and suppliers with contact nos.

- Company profile (if applicable)

- Leasing Contract (if applicable)

- Secretary’s Certificate/ Board Resolution (for corporation)

- Articles of Incorporation (for Corporation)

Usually, there are two (2) types of financing available for the mid-cost housing segment, Bank Financing and In-house Financing. But you can also personally apply for PAG-IBIG Financing.

- Bills payment (BDO, PNB, RCBC)

- Over the Counter (BDO, UnionBank)

- Online banking (BDO)

HOMEOWNER

House turnover is upon loan release and completion of documents and payments.

Once the property is ready for turnover, an Admin Officer will reach out to the buyer and schedule a briefing and check the property. The Buyer will receive a Notice of Turnover and an Acceptance of Property Form to be signed after the briefing and site inspection. After 60 days from the turnover date, the buyer can already move-in.

Specifications depend on the house unit that you availed.

For utilities such as electricity and water, the application will be done by the homeowner to their respective provider. However, if the subdivision is located within Metro Manila, Meralco applications will be processed by the developer.

You can apply for house improvement once you’ve signed the Notice of Turnover & Acceptance of Property form.

Homeowners Association Dues may vary depending on the location of your subdivision and the lot area of your property. For rates, you may inquire with the Admin Officer upon turnover or at your respective Property Managers.

Real Property Tax shall be paid and for your exclusive account upon turnover.

The transfer of title is included in the total contract price.

None.

SELLER

To become one of Camella’s accredited broker or sellers, follow these steps:

- Submit a filled-in Broker/Agent Accreditation Form with the following requirements to any Camella office, or via email.

- Photocopy of PRC License, if broker

- Photocopy of BIR Certification

- Two (2) 2×2 ID Photos

2. Training for Innovative and Professional Sellers (Product Knowledge Seminar) and site orientation

- Camella Marketing Officer of the Camella project you are interested to sell will contact you as soon as your application for accreditation has been reviewed.

- Camella will invite you for a Training for Innovative and Professional Sellers (Product Knowledge Seminar) and site orientation to familiarize yourself with the Camella project.

- Keep in touch with your Camella Marketing Officer to get updates on the prices, inventory, and promos of the specific Camella project you are selling.

Yes, Camella ensures that our property brokers and sellers are equipped with the right tools to succeed in real estate selling. Camella provides the necessary sales training and marketing materials to support them in their sales and marketing efforts.

Yes, Camella provides tactical seller’s promos and incentives from time to time in addition to the regular sales commission.